Reasons to Oppose House Bill 149 and Senate Bill 25

Don't be deceived by the name. House Bill 149, an act creating "opportunities in education" is bad legislation at the worst possible time. HB149 was drafted with the intent of providing tax credits to wealthy donors to give families the ability to use public dollars for private school tuition and for education-related expenses for all families. It is potentially devastating for public education in a state that is already financially sick.

Anyone that works in or supports public education should oppose the bill for the following reasons outlined below from Abby Piper of the Jefferson County Public Schools and the Kentucky Association of School Superintendents:

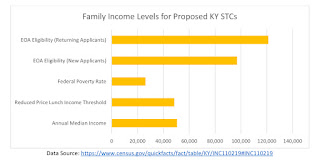

First, contrary to what many supporters will say, the bill does not target low-income families. Households making $96,940 per year for a family of four would be eligible – that number becomes $121,175 in income in the second year--which, as the chart illustrates, is over two times the median income for Kentuckians.

|

| Source: KASS |

Third, the bill does not create accountability for participating schools. Parents do not really have “choice” if they don’t have any data to compare between schools. Private schools do not participate in the state accountability system, do not have to comply with open meetings and open records, do not have to show data on disproportionality in disciplinary actions, expulsions, and do not have to serve English Language Learners. They can also cherry pick from among the applicant pool to accept only the highest-performing students and turn away students that may be more difficult to serve. It is not equitable or fair.

Fourth, the bill allows outright discrimination, creates privacy concerns, and could expose families to predatory vendors. Section 11(4) allows education service providers to discriminate against students and families based on their religion or sexual orientation at a minimum. The bill also prohibits unaccompanied youth from participating in the program. Predatory marketing could suck up program dollars without providing any measurable benefit to students and families. And, the bill does not require education service providers and account granting organizations to be FERPA compliant. This is not just inequitable or unfair, it is unconstitutional.

Comments

Post a Comment